Carbon Border Adjustment Mechanism (CBAM) Services

Understanding CBAM Regulations for Indian Manufacturers

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is a regulatory framework introduced by the European Union (EU) as part of its broader climate strategy, the European Green Deal. The primary goal of CBAM is to impose a carbon price on imports of certain high-carbon-intensity goods, ensuring that imported products bear a cost comparable to that imposed on goods produced within the EU. This mechanism aims to prevent "carbon leakage," where companies move production to countries with less stringent emissions regulations, thereby undermining EU climate efforts.

Applicability of CBAM to India

India is significantly impacted by CBAM due to its status as a major exporter of carbon-intensive goods, particularly in sectors like steel, aluminum, cement, and fertilizers. Starting from January 2026, importers in the EU will be required to report the carbon emissions embedded in these goods and purchase corresponding CBAM certificates if the emissions exceed certain thresholds. This regulation poses both challenges and opportunities for Indian manufacturers, necessitating strategic adjustments to remain competitive in the EU market.

Step-by-Step Approach for Compliance

To comply with CBAM regulations, Indian manufacturers should follow these steps:

Identify CBAM Goods: Determine which products fall under the CBAM regulations by reviewing the list of targeted goods.

Identify CBAM Goods: Determine which products fall under the CBAM regulations by reviewing the list of targeted goods.- Define Installation Boundaries: Clearly outline the boundaries of your manufacturing installations to assess emissions accurately.

- Data Collection: Gather relevant data on energy consumption and processing from all stages of production.

- Calculate Embedded Emissions: Use established methodologies to calculate the total carbon emissions associated with your products.

- Implement Monitoring Methodologies: Establish systems for ongoing monitoring and reporting of emissions data.

- Prepare for Reporting: Ensure that you can disclose emissions data in the required format by the deadlines set by the EU.

- Engage with Importers: Communicate with EU importers about your compliance status and any potential costs related to CBAM certificates.

How Quality Austria Central Asia Can Support Manufacturers

Comprehensive Support for Compliance

- Expert Advice: Quality Austria provides specialized advisory services tailored to the unique needs of Indian manufacturers. Our experts can help businesses understand the nuances of CBAM, including its implications for specific industries and products.

- Training Programs: Quality Austria offers training sessions aimed at educating stakeholders about CBAM requirements. This includes guidance on emissions calculation, reporting methodologies, and understanding compliance obligations.

- Data Management Solutions: To facilitate compliance, Quality Austria can assist in establishing robust data collection and management systems. This ensures that manufacturers can accurately track and report emissions data as required by CBAM regulations.

- Audit Services: Quality Austria provides auditing services to verify compliance with CBAM. This includes reviewing emissions data and ensuring that all calculations align with EU standards, thus preparing manufacturers for potential audits by EU authorities.

- Documentation Assistance: The organization helps in preparing the necessary documentation for CBAM compliance, ensuring that reports are complete, accurate, and submitted on time.

- Ongoing Monitoring and Support: Quality Austria offers continuous support to monitor changes in CBAM regulations and assists manufacturers in adapting their strategies accordingly to maintain compliance.

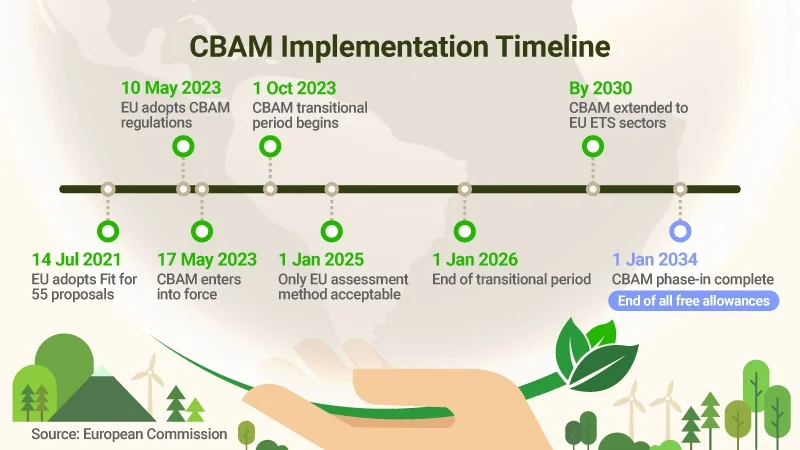

Timeline for Compliance

The timeline for complying with CBAM regulations is structured as follows:

- October 2023 - December 2025: Transition phase where manufacturers must begin collecting data and calculating embedded emissions without immediate financial penalties.

- January 2026 Onwards: Full implementation phase where financial adjustments will be required based on reported emissions, along with mandatory purchase of CBAM certificates.

By adhering to these guidelines and leveraging support from QACA, Indian manufacturers can effectively navigate the complexities of CBAM regulations while enhancing their competitive edge in international markets.

For any queries or further information related to our services, please feel free to contact us at info@qacamail.com or call us at +919599619392. We are here to assist you!