Risk Management

Risk Management Capacity Building Programme

Organizations face external and internal factors and influences that make it uncertain whether they will achieve their objectives. Risks underlie every business, some known and some unknown. Managing risk is vitally important and assists organizations in setting strategy, achieving objectives, and making informed decisions. Managing risk is part of governance and leadership and is fundamental to how the organization is managed at all levels. Risk management should be integrated with the entire business and cover all levels within organisations.

Managing risk considers the external and internal context of the organization, including human behaviour and cultural factors. Formal Risk Management uses 11 principles which can develop an effective risk management framework. Well-implemented risk management helps avoid failures of businesses.

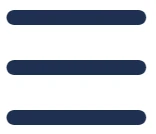

Demystify Risk Management

Risk management should be a continuous and developing process which runs throughout the organisation’s strategy and the implementation of that strategy. It should address methodically all the risks surrounding the organisation’s activities past, present and in particular, future.

It must be integrated into the culture of the organisation with an effective policy and a programme led by the most senior management. It must translate the strategy into tactical and operational objectives, assigning responsibility throughout the organisation with each manager and employee responsible for the management of risk as part of their job description. It supports accountability, performance measurement and reward, thus promoting operational efficiency at all levels.

Risk Treatment

The focus of good risk management is the identification, evaluation, analysis and treatment of risks. Its objective is to add maximum sustainable value to all the activities of the organisation.

It marshals the understanding of the potential upside and downside of all those factors which can affect the organisation.

It increases the probability of success and reduces both the probability of failure and the uncertainty of achieving the organisation’s overall objectives.

Risk management is essentially the Second Line of Defence of a business.

Interventions

RISK MANAGEMENT TRAINING

To develop a wider and comprehensive understanding of a broad section of the organisation in order for the larger part of the organisation to understand and implement risk management into their day-to-day activities.

RISK IDENTIFICATION, EVALUATION and RISK PROFILE

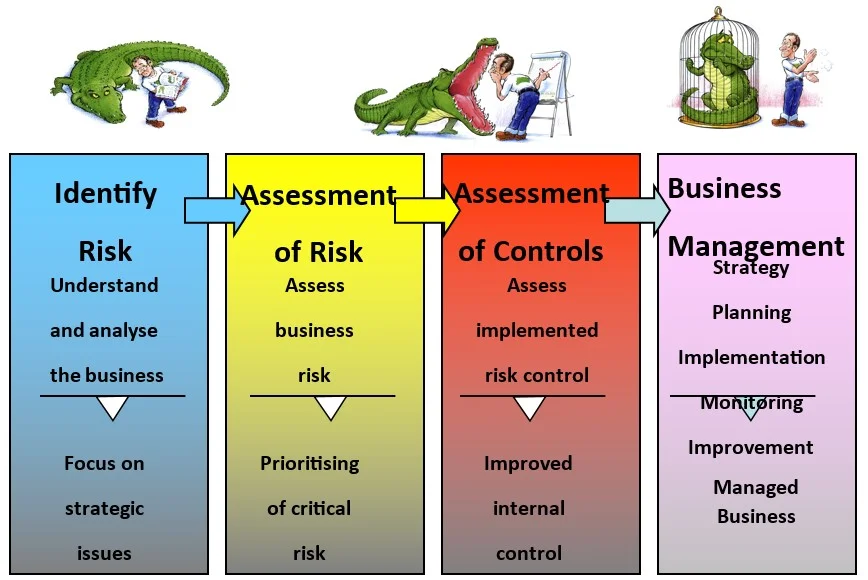

The facilitated workshop generates the Risk Factor of identified risks and compares them to the existing controls.

Business Risk Assessment (BRISK) is a simple, systematic and effective method that is supported by a web-enabled tool, to identify risks that a business faces at a given moment in time. For a company to have a clear understanding of its own position, and to create a management system to either reduce the risk or control it adequately, a formal analysis is essential. A second benefit of the business risk assessment would be the input available regarding the risk, to make strategic planning of the organisation.

Methodology: The BRISK-facilitated workshop is conducted with the top management who are decision makers. The BRISK is facilitated by one to two persons. The BRISK must be performed only with the managers who are involved in the business decision-making. This is because the business risks that are perceived by the management, are responded to by business plans, strategic planning and through management decisions. Involving those persons that are not part of this decision-making process would result in skewed results that will not be relevant to the organisation as business risk management may not be reflected truly. Top management must include the CEO of the organisation.

The role of the facilitator is important as he would provide the direction of the thought process and stimulate the identification of business risks and their importance to the organisation. The person who is facilitating must be a mature individual with extensive experience in management systems and not just experience in quality management. An assistant to this facilitator may become necessary for organising and conducting the BRISK workshop. The best facilitator is external to the organisation.

The BRISK workshop must be conducted with ample time being allotted-. The BRISK must be performed in an undisturbed condition and a relaxed environment. The preparatory work for the BRISK workshop is done by the facilitators. This involves studying the company's activities and Strategic Objectives and understanding the decision-making processes which help in preparing the questions that will trigger the participants to rationalise their thoughts.

The output of this exercise creates a visual risk profile

The graph has a direct visual display of the Risk Factor vs. Strength of Controls. It indicates the management where there is lower management attention on the business risks and where they would be able to focus their attention. The reverse implication where the strength of controls is more than the risk would mean that the organisation is wasting resources to over-control and indicating a management system that is not efficient. The attention of the management will also be drawn to the higher risks as indicated by the risk matrix heat map.

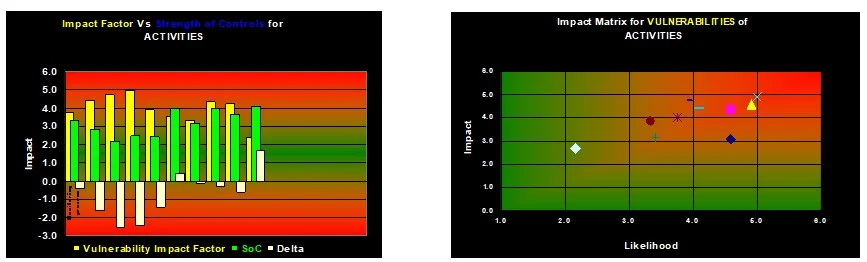

EMBEDDING

Integrating normal business management through a capacity building approach, whereby the risk management system is developed based on the 8 risk management principles, implemented and improved. These consist of a series of workshops, counselling sessions and coaching sessions, audits and improvement plans. The level of intervention is determined by the organisation’s current status on understanding and support needed.

Capacity Building Programme

For any queries or further information related to our services, please feel free to contact us at info@qacamail.com or call us at +919599619392. We are here to assist you!